Investors are currently in their second year of enduring severe financial volatility and some of the largest and most abrupt corporate collapses in history but the UK private investor remains philosophical about investing. While investor confidence has been significantly dented by recent corporate accounting scandals, surprisingly the events of the last years have not had the far-reaching effect on the private investor that many had forecast.

Indeed, three in every four (76%) investors are still committed to investing in shares in the long term. These are just some of the highlights from the most comprehensive market survey into the mood and motivations of the UK private investor published in recent periods.

This year’s survey is an indicator of the 9/11 effect as last year’s research, further topline results illustrate that:

– Only one in five investors (21%) feels they will always be more cautious in their attitude to investment in the future.

– While two thirds (67%) of private investors believe the underlying value of their portfolio has fallen in the last year, when asked the current value of their portfolio the estimated median value has increased to just under £5,500.

– There has been a significant impact from corporate accounting scandals as two thirds (62%) of UK private investors are now less trusting of all company reports and accounts.

– Exposure to the share market today is increasingly coming from employee share schemes (17% of shareholders say they initially came to shareholding via employee share schemes, although demutualisation (26%) and privatisation (25%) continue to be the dominant introduction to shareholding).

– The private investor is seeking less information on companies perhaps in an attempt to avoid bad news and also because of fewer purchases. For example fewer shareholders are consulting family/friends (19% c.f. 35% in 2001), TV programmes (16% c.f. 25%) and company’s own information (14% c.f. 30%).

– Trading activity remains low with an average of 3.2 trades in investor per year (compared with high of 5.2 in 2000). Shareholders are selling on fewer occasions than they did last year and increasingly cite market turmoil and crashes (up from 22% in 2001 to 31% in 2002) rather than price (which has increased slightly from 24% to 27% this year) or not needing the money (down from 34% to 26% this year) as the main reason for not selling their shares.

There has been much debate in recent months about how to restore confidence amongst investors in the aftermath of the more high profile corporate failures of the last couple of years.

Technology should be used to make corporate information more accessible, timely, and understandable to investors. The Internet is obviously the driving factor here. Technology is assisting investors in others ways. It is simple and inexpensive to make transcripts of earnings conference calls and analysts and shareholder meetings searchable by keyword, thereby making these events easier to navigate and more useful to investors who are not able to hear the call. Audio and video webcasting can bring management into shareholders’ living rooms. Email can inform shareholders of material news while analysts simultaneously receive it over their private networks.

The use of the Web to disseminate financial and other corporate information to investors is an important part of the corporate reporting scene today. However, most corporate Web sites need improvement in this area to restore investors confidence.

Corporate governance and its new approach is another view which is possible restore the investors’ confidence.

Far from just posting annual reports on investor relations (IR) websites, the more cutting-edge IR strategy today is to build interactive portals through which shareholders, employees, customers, analysts and potential investors receive the company’s key financial information and news. Some companies have made the choice to go web-only from now on. But any company that doesn’t embrace web communication for its key shareholders is ultimately, expand its business.

Arguably more important than the cost savings are the ways in which management uses Internet-based technology to engage investors and others in the company’s mission, in its story, so that those constituents develop more interest, confidence, and ultimately a greater financial stake in its business.

Because web content can be delivered with such flexibility, speed, and sensory impact, the web is an essential tool for companies that want to project themselves as innovative, forward thinking, and responsive to the needs of their constituents.

The fact is that most companies do a poor job of telling their stories, no matter what media they use. If an annual report takes too long to download, or audio links can’t be understood, a company loses visitors just as surely as if mails them a printed report that goes unread. Any company that does not fully answer the fundamental questions of investors and potential investors has failed in its primary task. But when companies get the presentation and content right online, the benefits and strategic advantages are myriad.

IR officers also need to understand that their websites must be able to supply customers and investors with a steady stream of convincing and credible information. An educated investor base tends to be more loyal investor base.

Technology now in development will allow even more sophisticated exchanges of information to occur on the road. Some investors now keep tabs on stock prices this way. In the near future, investors will be able to download press releases, quarterly financials, even see color flash presentation on live webcasts.

For now, the benefits to companies relying on standard html and basic flash technology to put their financial information online are compelling. Showing the personality of the CEO, for instance, can help generate more confidence in the company’s leadership.

The online connection with investors via IR site can become crucial at times or charge or upheaval within the company, when management needs to communicate directly, and quickly, with stakeholders.

Recognizing that your company is in crisis or headed for one is an essential first step in dealing effectively with a crisis event when it occurs. Basic recognition may sound all too obvious, but denial can rule the day until a fall into the abyss becomes inevitable. The problem is that the abyss is not, strictly speaking, the crisis itself, but the financial impact it can have on a company’s market valuation I both the short and the long term.

Investor relations, building a shareholder base, maintaining shareholder interest, and cultivating new investors, takes time and a true commitment on management’s part. When a crisis occurs, the quality of management’s relationships with key investors and analysts can affect the magnitude of the financial impact of a crisis. Simply put, management sells the company just as the marketing department sells its products and services. The importance of strong relationships cultivated over time cannot be underestimated when corporate challenges are at hand.

If a company responds immediately with financial and strategic information on its IR website, it could eliminate some of the heat generated by media coverage, which is often unsettling to both customers and investors. Companies that don’t use the web to put crisis-related issues in some context for the financial community are at the mercy of the press and the wild rumor mill.

Otherwise there are companies that have a completely different image problem: not enough people know who they are or what they do. Once again, a strong online presence can substitute for a multimillion pound advertising and marketing campaign.

Most IR professionals understand the wide impact an IR site can have, even if its penetration within the company’s current shareholder base is limited.

In a research that I realised I analysed different aspects of Investor Relations and in one of these I concentrated my attention on the importance of internet in the UK market.

And I obtained that Journalists, analyst and fund managers are making more and more use of the internet as a research and information tool and companies have to reflect that shift.

Use of email is also growing rapidly, the result is a more considered dialogue which can be very different from a phone conversation, with the time difference proving useful because the UK party can take time to mull over the query, and still send he answer back during the same US working day.

Any company setting up a website should bear in mind that it should not regard its site in isolation. The web is exactly what its name suggests and a web user can jump via connections called ‘hypertext’ or ‘ hot’ links from site to site.

The used already being applied to the internet go well beyond running a website. As well as posting documents such as the annual report on the web, increasing numbers of UK companies are putting all their corporate announcements on at the same time as they release them to the market.

For all these reasons I decided to ask to my respondents to provide the state of development of their companies’ Internet presence, and like I though all of them answered to have a web page, where company provide some financial information. All of them answered to have an investor relations section which aims to meet the information needs of existing and potential investors.

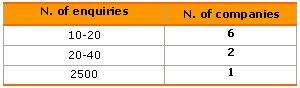

In a question respondents were asked to reveal approximately how many enquires they have each week from their web site concerning investor relations issue.

Table 1: Weekly enquiries on web site.

Like is possible to see from Table 1, 6 companies on 9, answered that their web sites produced 10-20 queries per week , there is just one answers that is much different to the other, with 2500 queries per week.

Â

But if I consider the company that answered like this, I realise that is the same company that organised 500 one-to-one meeting in a year. So I suppose that it is possible.

Â

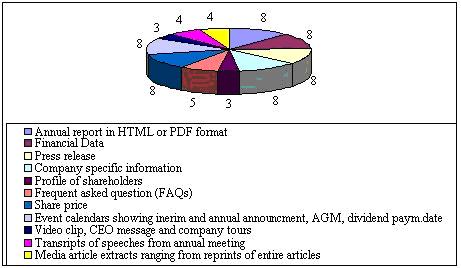

I decide to analyse and understand how the company organise their web page, so I formulated a question in which I asked to the respondents to specify how their company web page are structured and what they contains.

Chart 1: Information present in the respondents web pageÂ

From this chart is really easy to understand that Annual report in HTML or PDF format, financial data, press release, specific information about the company, share price and an event calendars showing interim and annual announcement are for all companies fundamental elements of their web site, the other type information are important too, but not for all respondents.

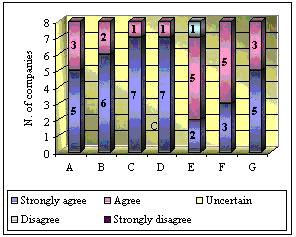

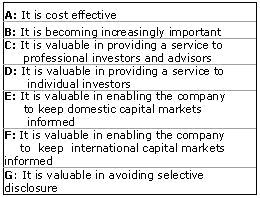

In another question respondents were asked to express own opinions about investor relations via Internet with the possibility to choose between different voice.

Results are showed in Chart 2.

Chart 2: Opinions about Investor Relations activity

Â

Almost all respondents are strongly agree to say that investor relations is becoming increasingly important, is a valuable in providing a service to professional investors and advisors and is a valuable in providing a service to individual investors.

For all other possibility respondents are almost all agree with the other possibility.

Just one respondent is not agree to say that investor relations is a valuable in enabling the company to keep domestic capital markets informed.

Indeed the practice of investor relations itself suggest that open, consistent, and honest communications with the investment community leads to credibility, and that building credibility in turn contributes to buying decisions. And the way to do this is, for sure, the use of Internet and all its tools.

Francesca Perani, Staff IR Top

f.perani@irtop.com